Short Term Loans

Ayesha Thomas

I found this company lovely and they have been beyond helpful very friendly can't do enough to make sure your OK and to help payments. I have used home credit before elsewhere but never will I use another company they are just fantastic and deserve 5 star I recommend to anyone thank you

Shela Sparkes

Would recommend this company, very trustworthy, polite, helpful service.

Missy Williams

Really friendly service, who are there to help those who need it. Their representatives are respectful & friendly. Love the personal touch I.e they come to your home, instead of other companies who do loans online. Interest rates are fair & making payments is easy. Highly recommend this Finance Company.

- Short term loans.

- Loans paid in cash or into bank account.

- Option to repay by Debit card

- No hidden costs or late payment fees.

- Pay weekly, fortnightly or monthly.

Representative example

Advance £200 – Repayable over 22 Weeks – Normal weekly payment £14.00 – Total amount repayable £308.00 – Representative 716.5% APR

Short Term Loan Lender

As a home collected loan company, we can provide direct to door loan services to our customers. We offer tailored repayment plans for all types of short term finance, and you’ll be assigned your own dedicated loan collector when you choose Valleys Finance. So if you’re searching for “Short Term Loans”, “Home collected Loans”, or something similar, then be sure to apply with Valleys Finance today. All loans are subject to the relevant credit, ID and affordability checks.

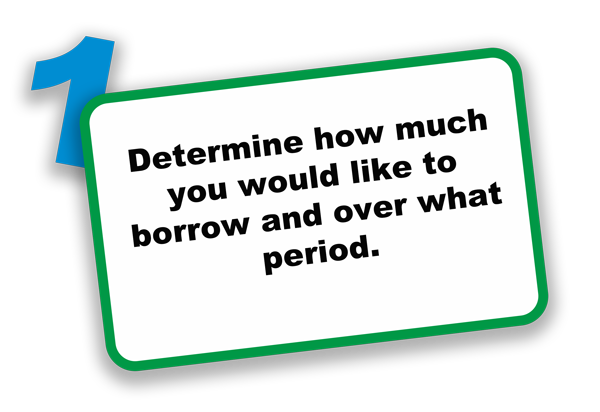

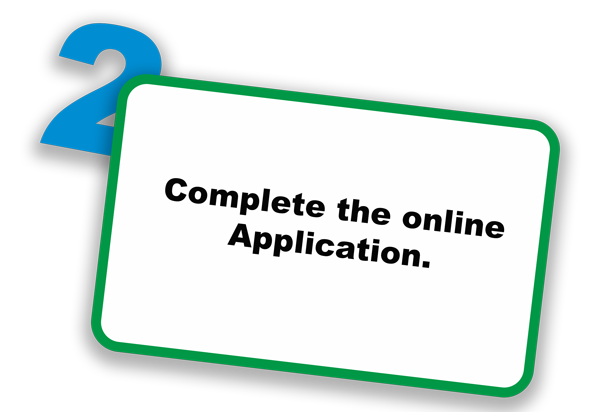

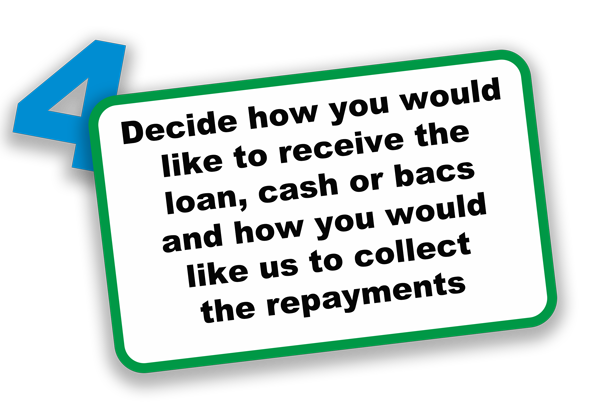

5 Easy Steps To Apply For A Home Collected Loan

+

+

Why Choose Valleys Finance For Loan Services?

- Over 60 years experience as a home credit lender.

- Member of the Consumer Credit Association.

- 000's of satisfied Customers.

- All costs laid out from the outset and no hidden charges or late payment fees.

- Authorised and regulated by the Financial Conduct Authority.

Next Steps For Loan Applications With Us

- Use the calculator to choose your requested loan.

- Complete the initial online application.

- If successful, we’ll arrange for our representative to take you through the affordability assessment to ensure that it’s the right loan for you.

- We’ll arrange when to collect your repayments, either from your home or by debit card.

Note – Before you apply there’s a a few things to check

- You must be over 18 years of age.

- Be resident in the UK.

- Have a regular income.

- Not have been declared bankrupt or had a DRO or IVA in the past 6 years.

- That you are not currently receiving debt advice over previous or current commitments.

Searching For Loans Near Me?

Should you be searching for “Loans Near Me”, then Valleys Finance can help you. We offer short term cash loans to customers across South Wales, Cornwall, Devon, Manchester, Merseyside and the West Midlands. Whether you’ve suffered a car breakdown, or simply need to cover the cost of a large purchase, or something else, a short term loan could be an option to consider. Our cash loans are designed to be taken out over a short period of time and loan repayments are tailored to suit your specific financial requirements.

Home Collected Loans - Frequently Asked Questions

Q. How much will the loan cost me?

A. See the loan calculator for the cost of the loan and remember there are no added fees or charges at any point after.

Q. What is an affordability assessment?

A. An affordability assessment is carried out each time a customer applies for a loan and is required to ensure that the loan is right for you today and for the term. It is a process of checks and questions carried out by one of our local staff when they visit you at your home.

Q. How soon can I expect to receive my loan?

A. We would aim to complete any successful applications within 2 to 3 working days.

Q. I don't have a good credit history. Can I still apply?

A. Of course you can. We will treat your application on its own merits, however, we cannot guarantee that every loan application will be successful. We only offer loans to people who can show that they're in a position to meet the repayments.

Q. Will my loan be recorded with a credit reference agency?

A. Yes. We are obligated to record all our loans with two CRA's and ongoing monthly payment history.